Pursue a Better Investment Experience

In our view, to create a better investment experience, individuals should focus on the things they can control. It starts when Eddy Financial creates an investment plan based on market principles, informed by financial science, and tailored to your specific needs and goals. Along the way, as advisors we can help you focus on actions that add investment value, such as managing expenses and minimizing taxes and portfolio turnover while maintaining broad diversification.

Equally important, we can provide knowledge and encouragement to help you stay disciplined through various market conditions.

*Required disclosure: Diversification does not guarantee a profit or protect against a loss.

Investment Philosophy

- Pursue a Better Investment Experience

- Where do returns come from? (Our View)

- Conventional (Opposing)

- Indexing (Opposing)

Strategic Asset Allocation

At Eddy Financial, we believe in strategic asset allocation and work with a handful of top tier provider partners. In strategic asset allocation, target asset class allocations depend on a number of factors – such as the investor’s risk tolerance, time horizon and investment objectives and change over time as these parameters evolve.

One strategic partner Eddy Financial works with identifies differences in expected returns and balances the trade-offs among competing premiums, diversification, and costs. This provider’s funds do not track an index, and this approach means that their funds trade on their own timetable rather than following indexing funds which buy and sell securities that are added or removed from a tracked index. This approach helps enable them to avoid overpaying or underselling securities. This partner has been implementing this strategy for over three decades for institutional clients. More than a decade ago, they began to allow individuals to invest in their funds through select advisors.

Bob was an early advisor to offer their funds and is proud of his long standing association.

Required disclosure: Asset allocation and diversification do not guarantee a profit nor protect against a loss.

Our View

The market drives returns, and portfolio structure and implementation determine performance. Our approach is informed by financial science and the view that market prices reflect all available information. We also believe that different securities can have different expected returns. Guided by this perspective, our approach looks to academic research to gain insight into the dimensions that drive those expected returns, then integrates this knowledge into strategies designed and implemented with the objective to add value in competitive markets. Rather than viewing the market universe in terms of individual stocks and bonds, an investment manager can define the market along the dimensions of expected returns to identify broader areas or groups that have similar relevant characteristics.

This approach relies on academic research and internal testing to identify these dimensions, which point to differences in expected return. Research shows that some market areas have higher expected returns than others. In the stock market, the dimensions are size (small cap vs. large cap), relative price (value vs. growth), and profitability (high vs. low). In the bond market, these dimensions are credit quality and term. The return differences between stocks and bonds can be considerably large. So can the return differences among a group of stocks or bonds.

To be considered a dimension, it must be sensible, backed by data over time and across markets, and ‘capturable’ in diversified, cost-effective portfolios. So, if there are systematic differences in expected returns and research has identified them, how can the insight be applied to practical investing? One may select broadly diversified portfolios that emphasize areas offering the potential for higher expected return. The strategies can emphasize securities with higher expected returns by over-weighting them compared to their market cap weight.

One way to visualize over-weighting is to think about an ice cube tray with sections that are shallower and deeper. In a portfolio, each section holds many stocks that compose a market area, and those with greater return potential are over-weighted, just like the large ice cubes.

In a dimensions-based approach, capturing returns does not involve predicting which stocks, bonds, or market areas are going to outperform in the future. Rather, the goal is to hold well-diversified portfolios that emphasize dimensions of higher expected returns and have low turnover.

Conventional Money Manager’s View

Performance comes from identifying “mispriced” securities or accurately predicting economic and market conditions. This approach attempts to “outguess” the market by buying a selection of securities. This approach can generate higher expenses, trading costs, and risk.

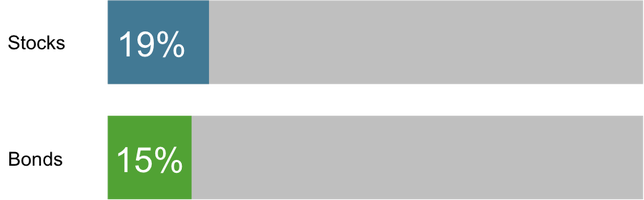

Research shows that conventional investing has low odds of success. Over the 10-year period ending in 2013, only 19% of stock managers and 15% of bond managers survived and outperformed their benchmarks. Said another way, 81% of stock managers and 85% of the bond managers who started the 10-year period under-performed their market index. About half of the stock and bond managers did not even survive the 10-year period.*

Some investors try to improve these odds by picking funds that have outperformed in the past. There’s a significant amount of research into the persistence of fund performance. It shows that among funds that outperformed in the past, only a small fraction continued to beat their market benchmark in the future.*

Should we be surprised by this poor record of performance? Not really. This makes sense if market prices are one of the best estimates of actual value.

Manager under-performance is not necessarily due to a lack of knowledge or expertise. In fact, many professional investment managers are very bright, educated, and hard working. The problem is that this high level of expertise and motivation results in intense market competition, which may drive prices to fair value. With the advent of computing power and data availability, academic research has documented the poor outcome of most conventional managers.* This is one reason for the rise in the popularity of another investment approach—indexing.

*Required disclosure: Past performance is no guarantee of future results. Bar chart represents fraction of mutual funds that survived and beat their index for 10 years, ending December 31, 2013. Survivors are funds that were still in existence as of December 2013. Out-performers are survivors that beat their respective benchmarks over the period. Source: Mutual Fund Landscape, Dimensional Fund Advisors 2014. US-domiciled mutual fund data is from the CRSP Survivor-Bias-Free Mutual Fund Database, provided by the Center for Research in Security Prices, University of Chicago.

Index Manager’s View

Indexing offers a number of investment benefits over a conventional approach. Broad-based indexes may offer better diversification, have lower fees, and follow a more transparent investment process, which means investors may have a clearer idea of what they are getting. One of the challenges with indexing is that the commercial index provider determines the stocks or bonds held in the portfolio.

The commercial index provider publishes a list—usually annually or semi-annually—containing all the stocks composing that index, or benchmark. The manager attempts to closely track the benchmark. But rigid construction can work against this strategy. Most index fund managers are judged by their ability to closely track their respective index. Some of the challenges with this approach are loss of control, trading disadvantage, and style drift. Let’s consider each of these issues.

An index manager does not start with the whole market, but with a list of stocks defined by the commercial index provider. The manager holds a basket of stocks in an attempt to match or closely replicate that list. The investment strategy is defined by a commercial index provider, and the manager has no control over what the fund holds. When the new list is released, managers must buy and sell at the same time to keep their portfolios (and returns) in line with the index. This updating process is known as rebalancing or index reconstitution.

Since the index list is public, everyone knows what the index fund is holding and when the index manager will rebalance. The index provider has shown the cards to the marketplace, and the index fund manager will have to trade with other managers who follow the index. This puts the managers at a trading disadvantage, which can result in higher costs. As a result, your investment may have drifted from what you intended. Security prices change every day to reflect the market’s latest expectations, but indices typically rebalance only once or twice a year. As new information is incorporated into market prices and securities start to exhibit different characteristics, the indexed portfolio can move away from its target universe or asset class. This is referred to as style drift, and it may happen to indices between reconstitution dates, leaving investors to hold stocks they many not want to own.